Bitcoin trading has recently become very popular. Due to the high volatility, which is sometimes responsible for double-digit % losses/profits, day and swing traders can make enormous profits.

While some do Bitcoin spot trading, i.e. simply buying/selling an asset, there is also margin trading with leverage. Here, Bitcoin contracts are traded on margin, usually on an ongoing basis. Leverage can maximise profits even further.

In this article, we will show you what margin trading and leverage actually are, how it works and what you should consider when trading Bitcoin on margin. In addition, we will introduce you to some trading platforms for trading Bitcoin on margin with leverage.

How does margin trading work?

Margin trading is not trading actual bitcoins, but bitcoin contracts. These can be various forms of derivatives, but are mostly contracts for difference (CFDs) that are traded continuously.

These bitcoin contracts can be traded on margin. This means that as a Bitcoin trader you borrow money from other market participants to trade these contracts.

This means that you trade with more than just your own capital, through the so-called leverage, and can therefore achieve more profits, but also more losses. This leverage can be up to x100.

The amount you put in yourself is the “margin”. If you trade 2000 US dollars with 10-fold leverage, you effectively trade with 20,000 US dollars. Thus, all profits and losses are multiplied by 10.

If the price rises by 10% this corresponds to 100% profit and vice versa, if the price falls by 10% it corresponds to a loss of 100%. The margin is then liquidated, i.e. you lose your invested capital if you have not set a stop loss.

How does funding work in margin trading?

As you have already learned, margin is the capital that you can borrow from other market participants. However, investors who do not want to trade Bitcoin can finance traders in this way.

In this way, the investors participate in the trades, regardless of whether they are successful or not. There are usually variable interest rates.

While this is a generally safe business, one should of course make sure to work with a reputable crypto exchange and to familiarise oneself with the funding mechanisms there in advance.

What is the best margin trading platform for cryptocurrencies?

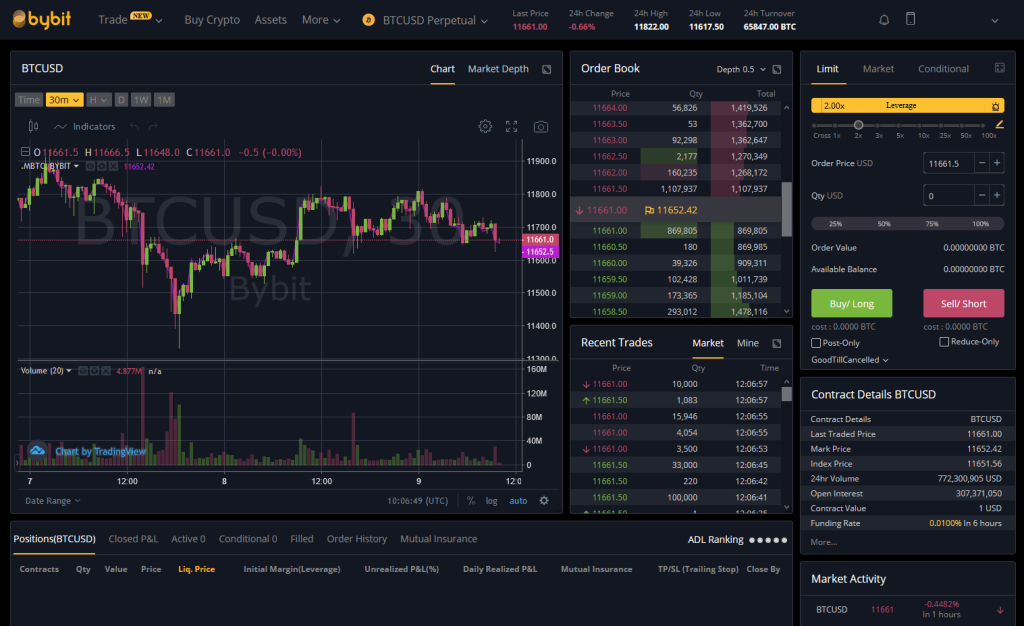

ByBit

ByBit is a relatively new exchange for margin trading with Bitcoin, Ethereum, Ripple and EOS. On Bybit, continuous contracts on the aforementioned cryptocurrencies can be traded with a leverage of up to x100 (for BTC) and x50 (ETH, XRP, EOS).

The Singapore-based crypto exchange, which trades under Bybit Fintech Limited, employs a large number of experts from various fields. These include the risk management team, which is made up of Morgan Stanley alumni.

Bybit has a strong focus on the security of the platform. For example, a hierarchical deterministic cold wallet system is used. All users’ funds are secured there, and withdrawals are processed manually three times a day.

In addition, the website is fully SSL-encrypted. All passwords and address information sent are secure.

- Multiple crypto assets: BTC, ETH, XRP, EOS

- No KYC (Know-Your-Customer)

- PnL in USUD and Bitcoin

- TP/SL with order entry

- Trailing stops

- Mobile app for Android and iOS

- No overloads due to trading engine with more than 100k TPS.

- 24/7 live support from the Bybit team

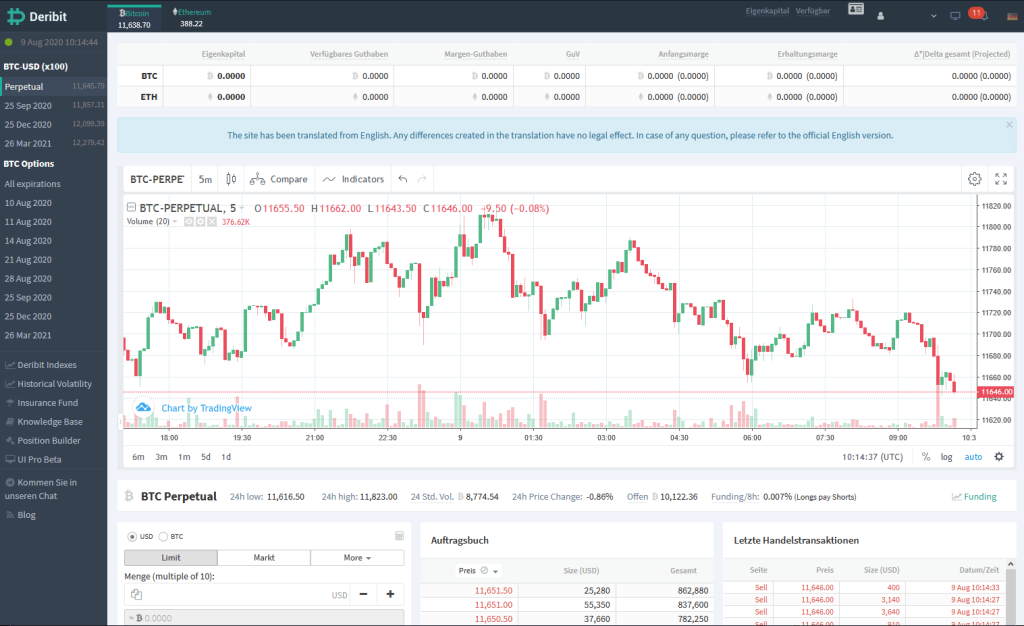

Deribit

Deribit is a crypto exchange that offers margin trading for Bitcoin and was launched in the summer of 2016. The founders are John Jansen, Marius Jansen, Sebastian Smycynski and Andrew Yanovsky, who are based in Amsterdam with Deribit.

In addition to contracts for difference, it is also possible to trade options and futures. However, these offerings are aimed more at professional traders who are used to the standards of the traditional derivatives markets.

Deribit can also process a large number of requests with a comparatively low latency.

Advantages:

- Test platform for new traders

- Low fees

- Fast trading

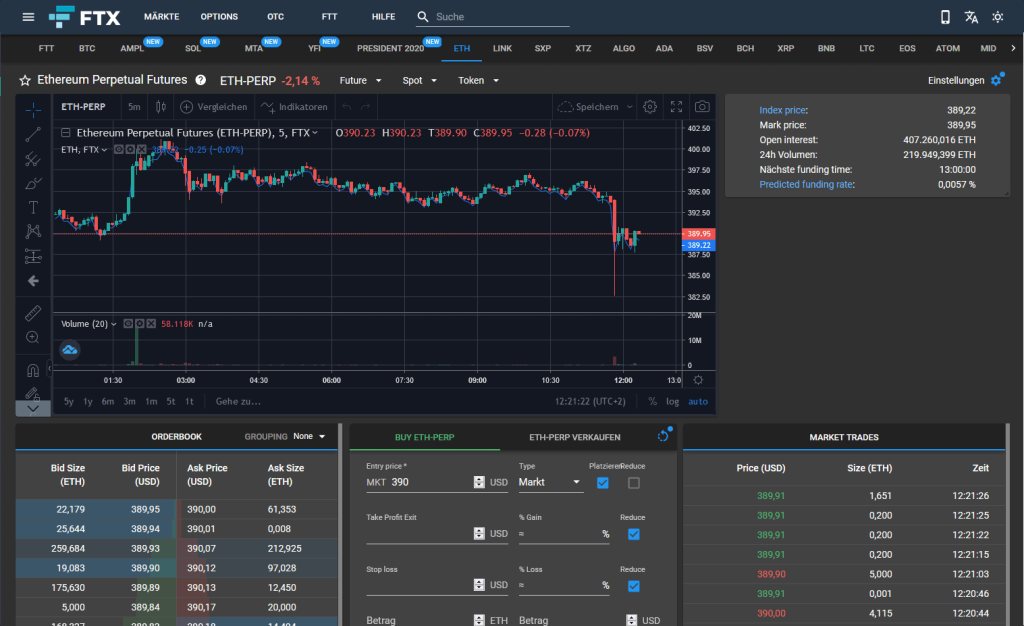

FTX

FTX was founded at the beginning of 2019 and offers professional derivatives for cryptocurrencies, including quarterly and open-ended contracts for various crypto assets.

Of course, it is also possible to trade with leverage. One of the investors in FTX is the world’s largest crypto exchange Binance.

Advantages

- Futures and derivatives trading

- Advanced features & a great trading interface

- Special products like altcoin trading with leverage

How high are the fees for margin trading?

The fee model for margin trading is identical in structure for most crypto exchanges. Only the amount of the fees can vary somewhat, as can the funding rates and intervals.

Basically, a distinction is made between two fees, the maker fee and the taker fee. The “maker” is the person who places his order in the order book.

As soon as this order is matched by another, it is executed accordingly. The trader who receives the maker’s order is therefore the taker.

When you create a limit order, you can be either a maker or a taker. This depends on whether there is already a matching order in the order book that matches yours and can be executed.

The maker fee is usually ~0.25% and the taker fee ~0.75%.

6 Tips for Margin Trading with Bitcoin?

Trading on margin with leverage carries great risks. The volatility of crypto assets such as Bitcoin is already very high in regular spot trading, and the leverage increases the risk proportionally.

You should always exercise caution and work with stop functions. Here are some tips that you should definitely take to heart:

Do not deal with money that you cannot afford to lose.

This is the principle of every good trader. You should never trade with more capital than you are willing to lose. This sounds simple, but for many people it is not.

Especially as beginners, many traders get carried away with making very risky trades with very high leverage, which can then quickly cost them their learning money.

Keep an eye on the news

Major news events affecting Bitcoin or Ethereum, for example, can seriously affect the price in either direction. If you trade on margin, you should always keep an eye on this.

Watch your liquidation price

Nobody wants to be liquidated in a trade. You would lose all the equity you have in the position. It is important never to liquidate. No serious Bitcoin trader works without stops.

Build positions over longer periods of time

Trades with high leverage from one minute to the next are exciting, but in the long run they are only for professionals.

As a beginner, you should rather trade for longer periods and slowly build up a long or short position. This will also give you better opportunities to react to short-term price fluctuations.

Build up your position over a longer period of time and not in a sequence. This lowers the level of risk and gives you the opportunity to react better to short-term fluctuations than if you enter with a single large order.

Monitor support and resistance levels

Support and resistance levels are very important and should always be considered when planning to enter or exit a position.

Take profits

It is also recommended to regularly take profits from successful trades and not to rely on luck that the price will continue to go in the desired/forecasted direction.

The past has shown that the wind can change very quickly, especially in the bitcoin market.

Conclusion: Bitcoin Margin Trading – High Risk, High Profits!

Bitcoin margin trading is only recommended if you have already gained experience as a day trader. This does not necessarily have to be in the cryptocurrency sector, even if you have already traded shares (put & call options), you will quickly find your way around and already know the risks.

Beginners should approach this topic very slowly and learn a lot first before trading with serious capital.